- Don't Let Overdue Invoices Choke Your Business 🙌

- +91 7019054978

- [email protected]

PayAssured provides comprehensive business credit reports, risk scores, and payment patterns for B2B debt recovery so you can make informed decisions, avoid risky customers, and protect your cash flow.

Check a Business NowComprehensive business credit analysis with detailed insights

Quick overview of the business's creditworthiness and risk level at a glance.

Detailed business information including registration, ownership, and operational details.

Historical payment patterns and behavior analysis for better risk assessment.

Current credit lines, loans, and financial facilities information.

Any legal proceedings, defaults, or negative credit events on record.

Key warning signs and risk factors that could impact payment behavior.

Protect your business with comprehensive credit analysis

Access detailed credit information to make smart business decisions and avoid risky customers.

Identify potential payment issues before they impact your business cash flow and operations.

Keep track of your current clients' credit status and payment behavior changes over time.

Set appropriate credit limits and payment terms based on reliable credit assessment data.

Credit checks are essential for protecting your business in various scenarios:

Comprehensive tools for business credit analysis

Simple 4-step process to get comprehensive credit reports

Provide business details and specify the type of credit check needed

We gather comprehensive data from multiple reliable sources and databases

Our experts analyze the data and generate detailed credit reports with risk scores

Receive comprehensive credit reports and recommendations for your business decisions

Everything you need for comprehensive credit analysis

Get up to 3 comprehensive credit reports annually for your most important business relationships.

Continuous monitoring of your key customers with alerts for any significant credit changes.

Share credit reports and insights with your team members for collaborative decision making.

Everything you need to know about our Advanced Credit Checks

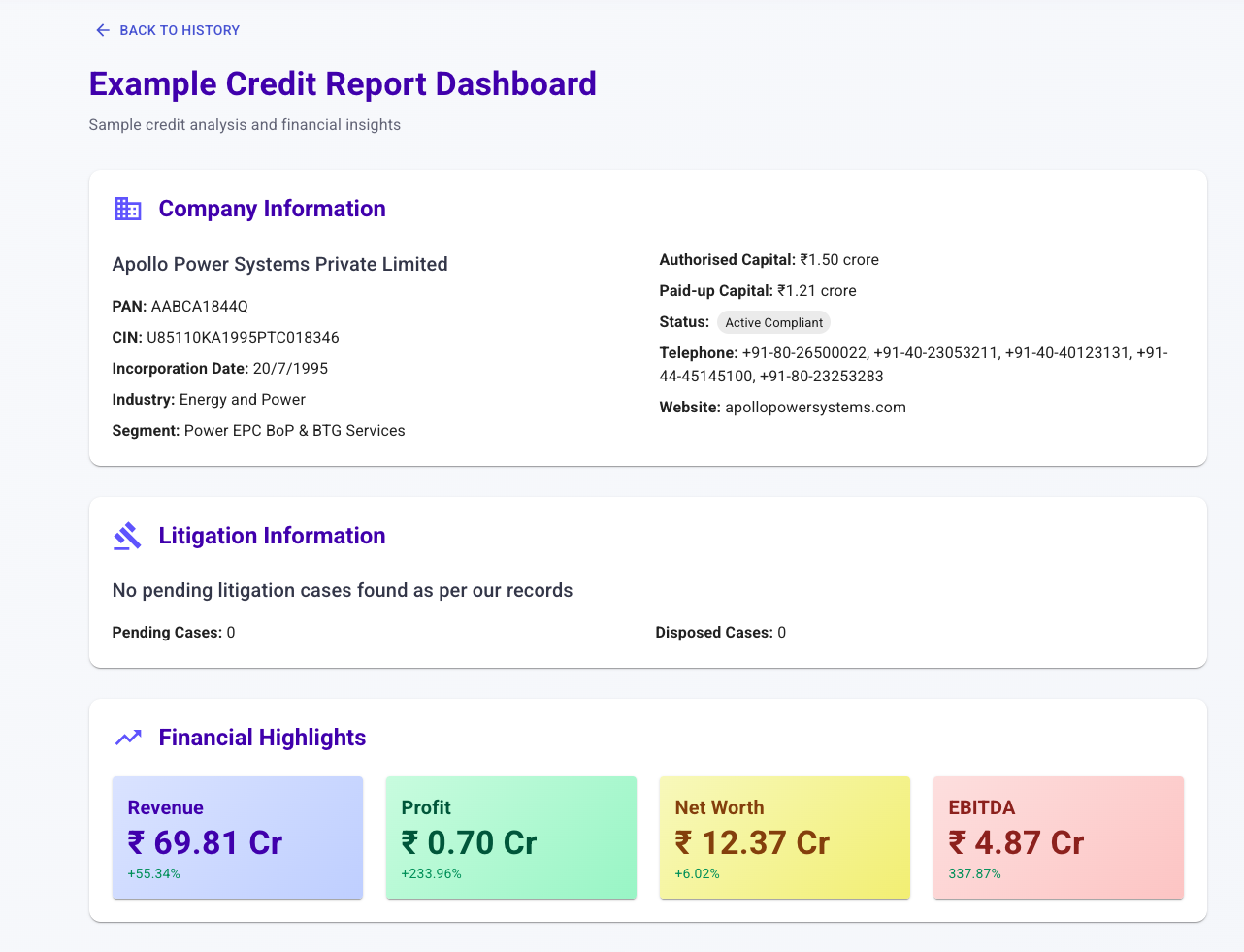

Our credit reports include comprehensive business information such as company profile, payment history, credit facilities, legal actions, defaults, risk indicators, and a detailed credit risk assessment. We gather data from multiple reliable sources to provide you with the most accurate and up-to-date information.

Our credit reports are highly accurate as we source data from multiple verified databases, government records, and financial institutions. We use advanced algorithms and manual verification processes to ensure the information is current and reliable. Our accuracy rate is over 95% based on customer feedback and verification.

We cover businesses across India including private limited companies, public limited companies, partnerships, LLPs, and sole proprietorships. Our database includes businesses from all major cities and towns, with comprehensive coverage of registered companies and their financial information.

Standard credit reports are delivered within 24-48 hours of request. For urgent requests, we offer express delivery within 4-6 hours for an additional fee. Complex cases requiring extensive research may take up to 72 hours, but we keep you informed throughout the process.

Yes, all credit check information is strictly confidential and secure. We follow industry-standard security protocols and data protection regulations. Your credit check activities and reports are only accessible to authorized users in your organization and are never shared with third parties without your explicit consent.

Yes, we offer bulk credit checking capabilities for multiple businesses. You can submit a list of companies and we'll process them efficiently, providing you with comprehensive reports for all businesses. Bulk processing is available for orders of 10 or more businesses with special pricing and faster turnaround times.